credit card annual fee reversal

Credit card use is both a boon and a bane. With unguided use, this convenient financial tool can ruin your financial life. To make the most of your credit card, it's best that you pay the balance in full on or before the due date. Otherwise, you'll carry the burden that is finance charge (FC) and additional payment of late fee if you pay after your due date has lapsed. Even if you religiously pay on time and in full, there's another charge that holders incur just for maintaining credit cards---the Annual Fee. Some banks refer to this as "Membership Fee" as in the case of Citibank. Generally, this is one way banks earn money, from people for using credit cards issued by them.

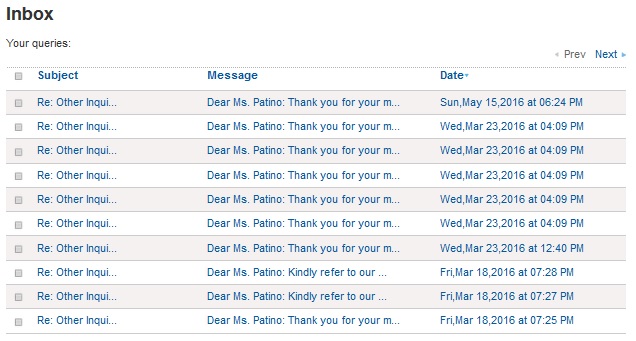

To keep track of my spending, I usually use plastic. Every time I use it, I logged it to an excel file I keep. While there are many apps you can download for this, my preference is still the old school spreadsheet. Anyway, when I logged into my online account, I noticed an amount that I couldn't remember ever "swiping". My excel file also showed no indication that I spent said amount to purchase something. As it turned out, it's the Annual Fee in the amount of PhP2,800. As it wasn't part of my budget for the month, I tried e-mailing the credit card company's customer service to request if there's a way that they could cancel the membership fee. After all, some credit card companies---Citibank including---now offer "No Annual Fee" promos to lure more customers into consumer credit. Also being a religious payer, I figured they'll give consideration. Normally, I just pay the AF without questions. But since I'm without a job and sticking to a budget is important, I tried to follow what I often read and hear about and request for Annual Fee reversal. From what I heard, you simply have to call the card company's hotline number and request for Annual Fee reversal. Some companies would readily grant the request for reversal, while others ask user to purchase a certain amount or avail of whatever is an on-going promo. As I'm NOT much of a phone person, I just opted to write an e-mail to make my request. Ha ha, as you can see I wrote at least five e-mail in a day to make the request. Unfortunately, all the requests where denied. Thus, I had no choice but to pay the billed Membership Fee the following month. I hate paying for financial charges, but as the MF wasn't in my budget for that month I was left with no choice but to underpay.

When requesting for annual fee reversal, many advised to keep calling the hotline until one gets an agent who would process the request. In my case, I just opted for e-mail to no avail. However, with Citibank, at the end of a log-in session, one is redirected to a page for an online survey. As a Psych student who was once had many papers requiring subjects/participants for surveys, I know how hard it is to get respondents to answer surveys. Thus, every time I see one, I normally would answer. Haha, I think it was a great move on my part. As it was a Customer Satisfaction survey, I mentioned that I was fully satisfied with the bank's services except for the AF request being turned down. I don't know whether it's pure coincidence or it's Citibank's way of trying to change my user experience---I was surprised to see that even after almost three months since I first made the request (March 2016), my Membership Fee was reversed soon after I replied to that survey! True that it took awhile, and I had already incurred a Finance Charge for failure to pay the MF in March, I was still ecstatic when I realized that Citibank actually reversed the Membership Fee in June. This was truly a case of "better late than never". If this was because of the Survey, I'm just happy that I answered it. I guess they don't want to get poor scores on certain metrics. But whatever the case, there's really no harm in putting in a request or answering surveys. You just don't know how the company would respond.

To keep track of my spending, I usually use plastic. Every time I use it, I logged it to an excel file I keep. While there are many apps you can download for this, my preference is still the old school spreadsheet. Anyway, when I logged into my online account, I noticed an amount that I couldn't remember ever "swiping". My excel file also showed no indication that I spent said amount to purchase something. As it turned out, it's the Annual Fee in the amount of PhP2,800. As it wasn't part of my budget for the month, I tried e-mailing the credit card company's customer service to request if there's a way that they could cancel the membership fee. After all, some credit card companies---Citibank including---now offer "No Annual Fee" promos to lure more customers into consumer credit. Also being a religious payer, I figured they'll give consideration. Normally, I just pay the AF without questions. But since I'm without a job and sticking to a budget is important, I tried to follow what I often read and hear about and request for Annual Fee reversal. From what I heard, you simply have to call the card company's hotline number and request for Annual Fee reversal. Some companies would readily grant the request for reversal, while others ask user to purchase a certain amount or avail of whatever is an on-going promo. As I'm NOT much of a phone person, I just opted to write an e-mail to make my request. Ha ha, as you can see I wrote at least five e-mail in a day to make the request. Unfortunately, all the requests where denied. Thus, I had no choice but to pay the billed Membership Fee the following month. I hate paying for financial charges, but as the MF wasn't in my budget for that month I was left with no choice but to underpay.

When requesting for annual fee reversal, many advised to keep calling the hotline until one gets an agent who would process the request. In my case, I just opted for e-mail to no avail. However, with Citibank, at the end of a log-in session, one is redirected to a page for an online survey. As a Psych student who was once had many papers requiring subjects/participants for surveys, I know how hard it is to get respondents to answer surveys. Thus, every time I see one, I normally would answer. Haha, I think it was a great move on my part. As it was a Customer Satisfaction survey, I mentioned that I was fully satisfied with the bank's services except for the AF request being turned down. I don't know whether it's pure coincidence or it's Citibank's way of trying to change my user experience---I was surprised to see that even after almost three months since I first made the request (March 2016), my Membership Fee was reversed soon after I replied to that survey! True that it took awhile, and I had already incurred a Finance Charge for failure to pay the MF in March, I was still ecstatic when I realized that Citibank actually reversed the Membership Fee in June. This was truly a case of "better late than never". If this was because of the Survey, I'm just happy that I answered it. I guess they don't want to get poor scores on certain metrics. But whatever the case, there's really no harm in putting in a request or answering surveys. You just don't know how the company would respond.

Comments