Gone were the days that one needs to visit a PAG-IBIG branch in order to pay one's housing loan. Of course, one could still pay over the counter in any PAG-IBIG branch, partner channels like SM bills payment, LBC's Bayad Center, and more; but these days, paying your housing loan—even monthly membership contribution (if you're self-employed or voluntary member) and MP2 (modified PAG-IBIG 2)—is made more convenient through different online channels.

1. PAG-IBIG Fund Services or Virtual PAG-IBIG

Simply visit their website, and fill out the necessary details, and you're done. The online payment facility is very easy to use as well. Upon clicking on the Housing Loan option, you'll be required to fill in details such as membership category (local or overseas), payment method (credit or debit card or PayMaya or GCASH), housing account number, and the amortization amount. All these are mandatory fields that need to be filled out. Then input the borrower's name, the amount due, convenience fee, and total amount due. Upon inputting the amortization amount, the system automatically fills out last two fields—the amount due, the convenience fee (PhP5) and the total amount due. You will then need to fill out your billing address and contact information. After which, you just need to verify the inputted details with the provided merchant reference number, and then click on Proceed to continue with the payment process and follow succeeding prompts.

2. Metrobank Online or Metrobank Mobile

This is my go-to online payment channel as there is no convenience fee; bills payment is free. You can either go online through Metrobank Online, formerly called Metrobankdirect, or you can use Metrobank's mobile app. This one's much more easy to do as you don't have to input as many information as you're required to do unlike in the PAG-IBIG's own online payment facility. You simply need to look for PAG-IBIG in the biller's list, input your reference number (which you can find in your billing statement), and the amount, and you're done. It's also safe as you will be required to input a one-time password (OTP) that will be sent to your mobile number for security reasons. For a step-by-step procedure on how to use this online facility, simply visit an earlier post entitled Pay PAGIBIG Housing Loan via Metrobankdirect. The post is a bit dated (2018 last update), but it still works the same way, so it should be a fine guide to refer to still.

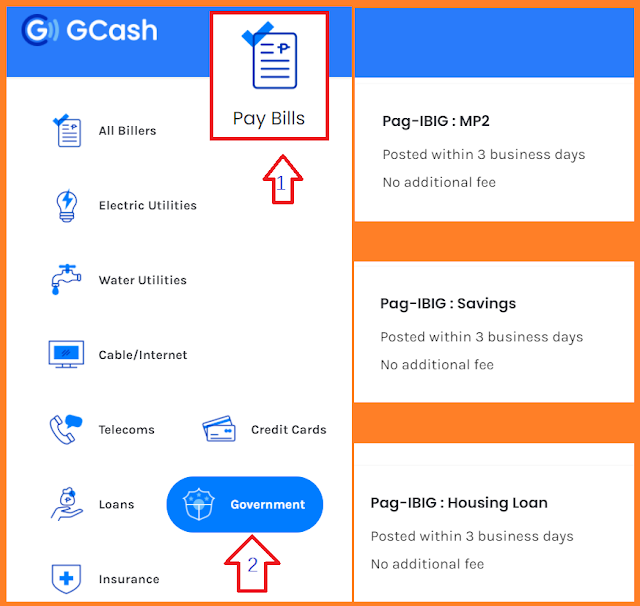

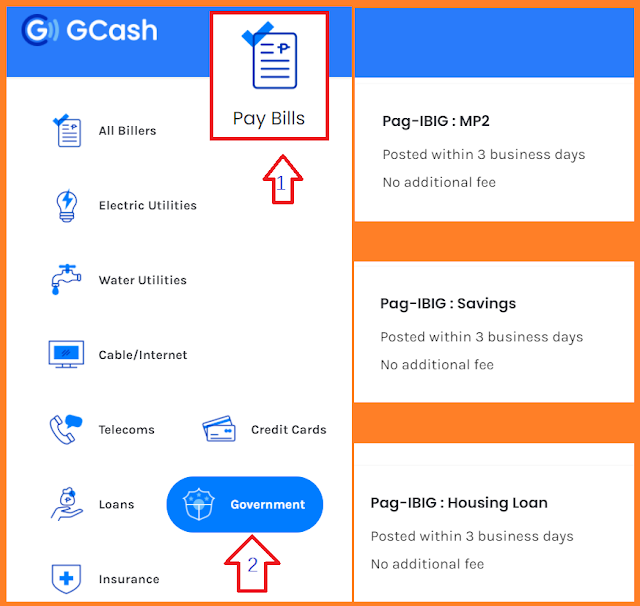

3. GCASH App

True to an app's promise of convenience, paying your housing loan through GCASH is truly easy. You simply need to look for the Pay Bills section in the GCASH app and the Government. Then just scroll through the menu until you find PAG-IBIG.

Once you find PAG-IBIG, then you only need to input the required fields: type (select Housing Loan), account number (Enter the 12-20 digit MID or Housing Loan ID number), amount, period covered from, period covered to, and email address. Email address is optional, but I suggest you fill that out as well so you will have a copy of your bills payment. Press Next and then Confirm the details, and Pay. You will be charged PhP5 convenience fee for using this channel. You should receive an SMS notification that your payment has been successful. Your payment will be posted within 3 banking days.

I tell you, it's that simple. If you don't have a GCASH app yet, register an account one now and enjoy the convenience of paying in just a few steps.

4. Coins.ph App

Coins.ph works just like GCASH. They just vary in their user interface. Upon opening your Coins.ph app, simply go to Pay Bills. Scroll through the menu until you find Government. Then select Pag-IBIG Housing Loan Amortizations.

Once in, you'll be asked to enter the amount you wish to pay. Click on Next. Then just input your phone number and your Payment Reference No. (PRN).

You can find your PRN from your monthly billing statement—the 20-digit number—like so in the image below.

Once you input the PRN. Just follow the next prompts. You will be charged PhP7 convenience fee. But with Coins.ph, they have a PhP5 rebate every time you pay a bill, so technically, you'll only be charged PhP2 pesos for using this facility in paying your PAG-IBIG housing loan amortization. An email notification will be sent to your registered email account once payment is successful. Oh bonus, if you pay 5 distinct bills using Coins.ph within the same week, you'll get a rebate of PhP100 (as of current writing).

With the pandemic going on, these 4 different channels of online payment are truly a blessing as you can do your cashless transaction at the convenience of your home, at any time, for as long as you have internet connection.

Comments